🪙 What Do Fed Rate Cuts Really Mean — And Why Gold Prices Are Soaring in 2025

Have you noticed how gold prices are suddenly breaking records again? From headlines about “Fed rate cuts” to whispers of “gold hitting new highs”, the connection between the U.S. Federal Reserve’s decisions and your jewelry or investment portfolio has never been clearer. But what exactly does a Fed rate cut mean — and why does it send gold prices skyrocketing? Let’s dig in.

Understanding Fed Rate Cuts: The Basics

When the U.S. Federal Reserve cuts interest rates, it’s trying to stimulate the economy. Lower rates make borrowing cheaper for banks, businesses, and consumers alike. Think of it as the Fed pressing the “boost” button on growth. When loans, mortgages, and credit become cheaper, spending and investment increase. But here’s the twist: those same rate cuts ripple across the world — weakening the U.S. dollar, lowering bond yields, and making gold shine brighter than ever.

How Rate Cuts Turn Gold Into a Star Performer

Gold and interest rates have a long, inverse relationship. Whenever interest rates fall, gold tends to rise. Why? Because lower rates make gold more attractive.

- Cheaper to Hold Gold: Gold doesn’t earn interest. When rates drop, the cost of holding gold instead of bonds or deposits becomes minimal.

- Real Interest Rates Go Negative: If inflation stays high while nominal rates fall, real returns on savings turn negative — and investors flock to gold as a safe, inflation-proof asset.

- A Softer Dollar Makes Gold Shine: Since gold is priced in dollars globally, a weaker dollar makes it cheaper for other countries to buy, pushing up global demand.

- Safe-Haven Magnet: When rate cuts arrive during uncertain economic times, gold acts as a trusted safe haven.

In short: lower rates make gold irresistible to investors seeking stability and protection.

2025: The Year Gold Took Off

The results of the Fed’s 2025 policy shift are impossible to ignore. With multiple rate cuts and growing expectations of more to come, gold has been on a record-breaking run. Globally, gold prices have surged by nearly 40% year-on-year, reaching all-time highs above $3,800 per ounce. In India, gold futures have jumped past ₹1,18,000 per 10 grams, reflecting both the global uptrend and a weaker rupee. Gold has risen about 48% this year, reaching multiple all-time highs, and is on track for the biggest annual gain since 1979. That’s not just a rally — it’s a full-blown gold rush. Just a year ago, in October 2024, gold hovered around ₹85,000 per 10 grams. Fast forward to October 2025, and we’re seeing prices up by nearly ₹30,000 in a single year.

What to Watch Next

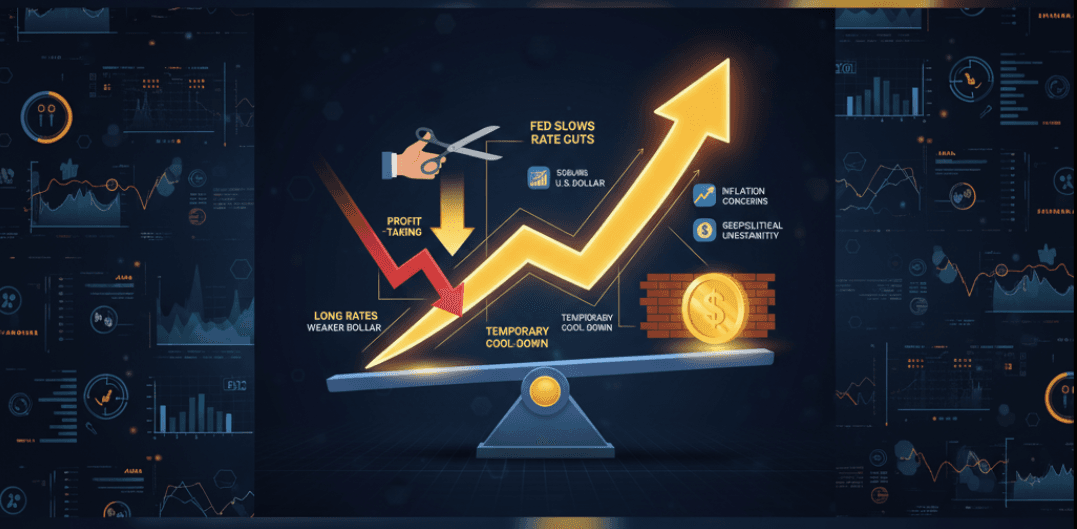

The gold rally might not be over yet — but investors should stay alert. If the Fed slows its pace of cuts or signals fewer in 2026, gold’s momentum may cool temporarily. A stronger U.S. dollar could also limit short-term gains, and some profit-taking is likely after such a steep rise. However, with inflation concerns, geopolitical uncertainty, and low real rates persisting, gold’s long-term story remains bullish.

The Takeaway

The Fed’s rate cuts have done more than just stimulate the economy — they’ve rekindled global confidence in gold as the ultimate safe-haven asset. In 2025, gold isn’t just shining — it’s blazing. With a 40–48% surge in a single year, gold has once again proven why it’s called the metal that never loses its luster. So whether you’re an investor, trader, or simply curious about market trends, remember this: when the Fed cuts rates, gold usually takes off — and this time, it’s flying higher than ever.

Related Posts

Why Bitcoin Crashed from $126K to $90K: What Really Happened?

Why Bitcoin Crashed from $126K to $90K: What Really Happened?November 18, 2025